LIVE INSURANCE: ARGUMENTS AND FACTS

Life insurance in Canada is an important factor, part and parcel of financial well-being of country’s citizens, of those, who should bear no doubts about the need to protect themselves and their families against different types of risks. On multiple occasions I had to come across cases, when opportunely executed insurance plan changed people’s destiny, averted family’s financial disaster, helped alleviate sufferings during a grave illness, etc. Though in this article I would like to move to background the evident emotional arguments for the benefit of insurance, and would like instead to consider peculiarities of those insurance plans, which would become your financial strategy for long years, bringing you real financial dividends.

Many know that Life Insurance benefit is paid only on occurrence of an insured accident: that is, it order to receive it you need, sorry to say, simply to die. Company pays out benefit to heirs immediately if the plan existed for not less than two years. And the range of possibilities to use that money depends only on those, whose hands they get into: heirs, executors, sheriffs or entities receiving charity money per will. The way they can be used deserves a separate conversation and attention, as the benefit amount is not taxable. That’s how absolutely all the insurance plans from Life Insurance family work. But some plans work only thus and in no other way, and they is called Term Life Insurance. There are also others…

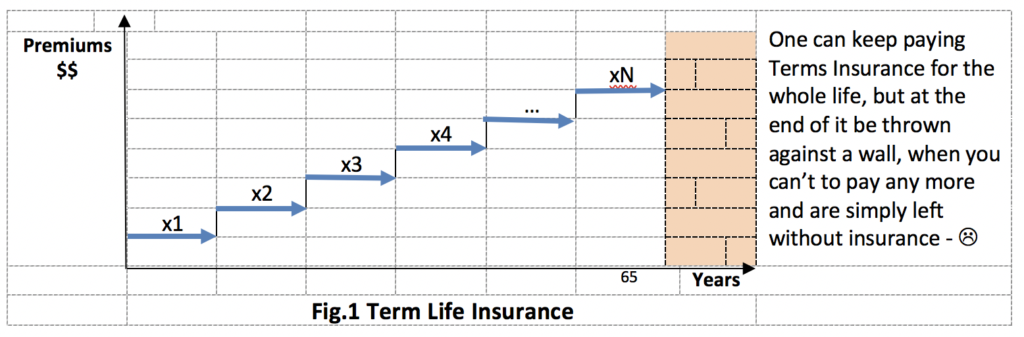

Statistics reveal that virtually 85% of all Term Life insurance are not paid out by insurance companies due to three reasons. Sometimes insurance plan holders practically do not need Life Insurance (no mortgage, no children, nothing to bequeath) and cancel plans earlier or at the end of the term. This is one of the cases. After renewing the insurance for the next term 5-10-20-30 years, payments increase manyfold and can’t be budgeted any more by the insurance plan holder. This is the second reason. And the third case is when people frequently outlive their insurance, which they had been paying off for many years. Then, at advanced age, when elders especially need protection, they are left without insurance due to their years. Figure 1 gives a graphic presentation of a term life insurance.

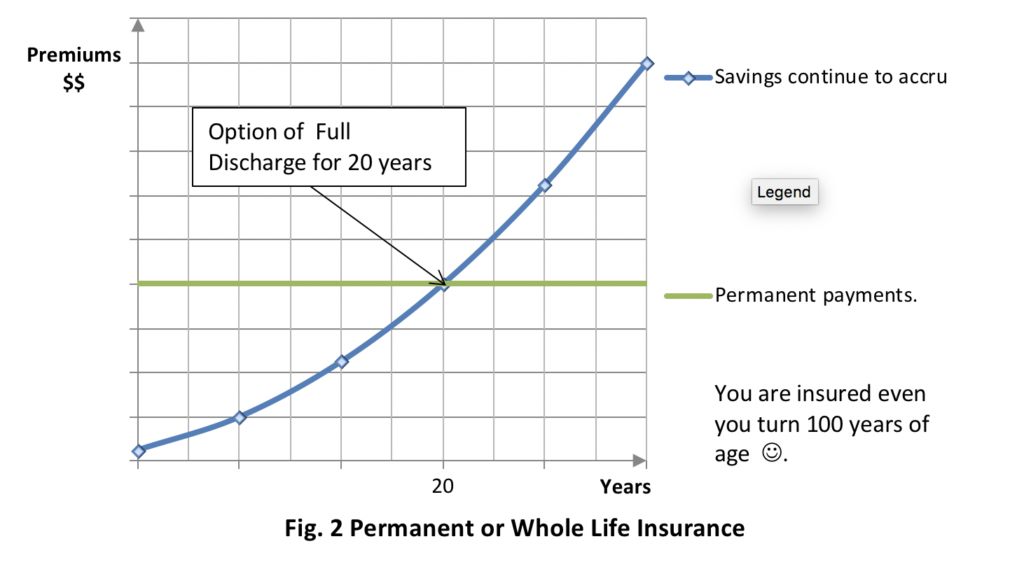

Other plans from Life Insurance family are called Permanent Life Insurance, they work lifelong. One can not outlast them. They stay with you, ensuring your financial assistance for life. One can treat term life insurance as a “one way ticket with rent attached”. Then permanent life insurance plan is an ideal instrument to save money, to use them whenever they are needed, to inherit or bequeath it. Plus your savings and the final benefit are placed “in different baskets”. Even though the baskets are interconnected, it does not detract from the ability to have, let us say, a constant income when on pension, still leaving a considerable portion for succession. One won’t have the heart to call this product just insurance; it instills deference and can not be called anything but Insurance Plan. It makes part of financial plan, has multiple options and applications. For example, one can draw it with payments for twenty years, with a known guaranty of money accumulation, and then it will bring you fixed income. In any case, your installments become your savings, being set to a professionally monitored automatic pilot and being directly detached from market fluctuations, as you participate in an insurance company’s dividends.

Figure 2 reflects the way Permanent Life insurance works.

The graph shows continued accumulation of capital after twenty years, after all the insurance payments are done. In case if the plan provides for constant payments during the whole life term, the contract can be reissued to another holder. Only an insurance company with multiple years of experience and an immaculate name can assume such serious commitments.

I would like to advise you to consult an insurance expert, who will give you good advice based on analysis of your situation: under which conditions and with which company it would benefit more to draft such a plan. Many financial experts can tell you that for the last twenty years this product keeps providing one of the best ways to accumulate and safeguard money under conditions, when market had already fallen twice. In my experience, after 5-10 years of starting such plan, clients estimate this product as being unique. It provides you with:

- Life Time Return;

- Guarantees;

- Tax Advantages;

- Low Volatility;

- Immediate vesting (the most important!)

You can never have a negative return!

Regretfully, starting from 2017, accumulating insurance plans will undergo changes in the ways of taxation and limiting the amounts which can be accumulated and withdrawn from the account. On converting term life insurance into permanent one, the age at the moment of converting will be considered, which relates to the amount of payments. Some other limitations will be put into effect, and I can expand on this during consultation. For those who managed to set such a plan this year, all the prior advantages will be preserved.

I wish you all considered decisions and actions, leading to pleasing results. Health, money and time are three factors, which should work simultaneously for you, making you happy.

Elena Shatravka,

Financial Advisor, M. Eng., CPCA, CLU®